Stock Market Weekly update -Mar 12th

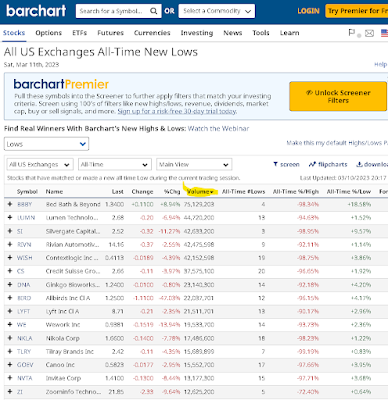

The 2 day relief rally was followed by a 'tail' candle on Monday, then we never looked back, dropping about 200 points on the SPX for the week! Part of the drop was blamed on the Fed's presentation, and part due to the collapse of 2 banks! We have now broken down, back below the weekly downtrend line, not a good sign for markets. Of course the VIX finally rallied. Next week we could see more turmoil in markets as we get the CPI & PPI inflation reports.

2nd largest Bank collapse in history last week!

Takeaways from America’s second-largest bank failure

The long term weekly 'downtrend' from the January 2022 high continues in the SPX (weekly 20MA line). --price broke down below that downtrend line last week.

Less likely now, but this weekly trend could also eventually take us down to the pre-Covid highs of early 2020! The DOW & the Small-caps have already touched that level and rallied back up (see pics below).

Pops & Drops: DOCU dropped

| ETFs | SPY, IWM, QQQ, SQQQ/TQQQ, XLF, XLE, EEM, GLD/SLV, | |

| Stocks | AAPL, AMZN, GOOGL, TSLA, META, MSFT, NVDA... |

Comments

Post a Comment