Stock Market Weekly update -Mar 19th

Despite a tumultuous week, we ended higher than the prior week's low on the SPX, and actually higher than the prior week's HIGH on the Nasdaq 100, and lower than the prior week's LOW on the SmallCaps.! Financials tumbled, almost to the Oct low, as banking issues continue to percolate.

The VIX rallied for a 2nd week. Next week we could see more turmoil in markets as we get the CPI & PPI inflation reports.

The long term weekly 'downtrend' from the January 2022 high continues in the SPX (weekly 20MA line). Less likely now maybe, but this weekly trend could also eventually take us down to the pre-Covid highs of early 2020! The DOW & the Small-caps have already touched that level and rallied back up (see pics below).

NYA (NYSE composite) & IWM (small-caps): -both dropped.

The Dollar dropped, as did Interest rates.

Gold rallied for a 3rd week.

Oil dropped, and broke below the 2 month rangebound lower level!

Bitcoin/Crypto saw a big rally!

What to Expect in the Markets Next Week - big Fed meeting! Bank issues?

Pops & Drops:

1/1/23: Indexes vs Pre-Covid early 2020 highs -the DOW already got there & reversed

Market concerns: Inflation, Rising Rates, Russia/Ukraine, Banks

Over $31 Trillion in debt! See Debt Clock on the left, or here...

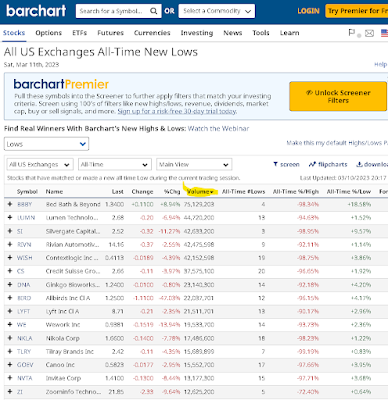

New all time lows: BBBY, GRPN, CS, RIVN, -

Options watch: S&P 500 Implied Volatility (CBOE VIX) -dropped again

| ETFs | SPY, IWM, QQQ, SQQQ/TQQQ, XLF, XLE, EEM, GLD/SLV, | |

| Stocks | AAPL, AMZN, GOOGL, TSLA, META, MSFT, NVDA... |

This week's charts:

Delinquent consumer loans..

3/05: Credit Suisse -Never recovered since 2007

..and here's another one -Citi

Links...

Comments