Stock Market Weekly update -Jul 30th

We got yet another move up last week, closing around 4582 on the SPX, after a huge drop on Thu, followed by a huge recovery on Fri. The weekly uptrend continues in the SPX & the Nasdaq 100. CVX & XOM dropped a bit on earnings, despite rising Oil prices. CMG & MSFT dropped, while GOOGL & META popped. BA also popped. We also got a good GDP report last week.

More 'tech' earnings this week (AAPL, AMZN, AMD...), as well as from other big companies. Other events include the Jobs report on Fri.

The Dollar -was up for a 2nd week! Likewise for the 10Yr Interest rate.

Gold was flat, while Oil was up for a 5th week!

Bitcoin/Crypto -still flat for a 4th week after the big rally.

What to Expect in the Markets Next Week - Earnings, Jobs report

Pops & Drops/5 day movers: NIO, XPEV, QS, TUP, TLRY, ROKU, TDOC, UPST

New all time Highs: KLAC, ON, SKX, SMCI, WMT

-all time LOWS:

1/1/23: Indexes vs Pre-Covid early 2020 highs -the DOW already got there & reversed

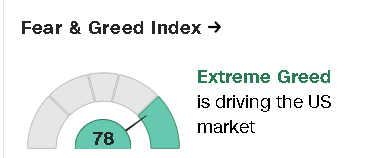

Market concerns: Inflation? Interest rates?

Over $32 Trillion in debt! See Debt Clock on the left, or here...

Options watch: S&P 500 Implied Volatility (CBOE VIX) -down a bit -still near multi-year lows!

| ETFs | SPY, IWM, QQQ, SQQQ/TQQQ, XLF, XLE, EEM, GLD/SLV, VIX | |

| Stocks | AAPL, AMZN, AMD, GOOGL, META, MSFT, NVDA, TSLA... |

This week's charts:

Links...

Comments

Post a Comment